Accordingly, the information provided should not be relied upon as a substitute for independent research. does not have any responsibility for updating or revising any information presented herein. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Applicable laws may vary by state or locality. Additional information and exceptions may apply. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Use this calendar to help guide your filing processes:

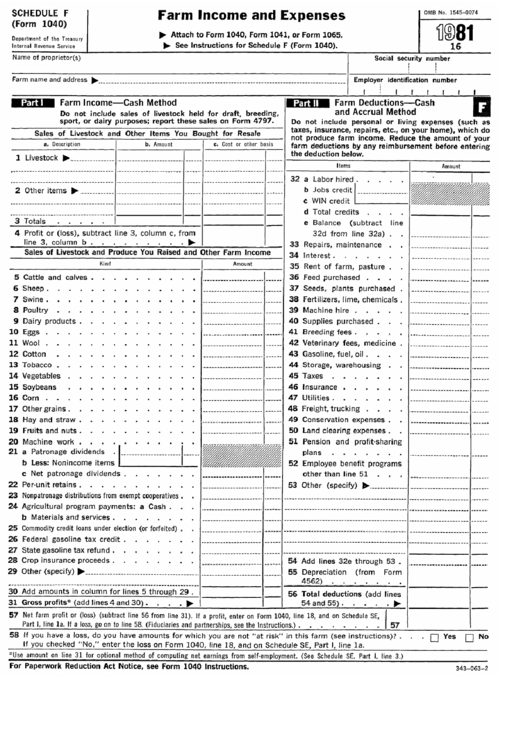

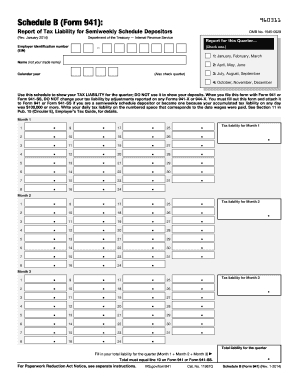

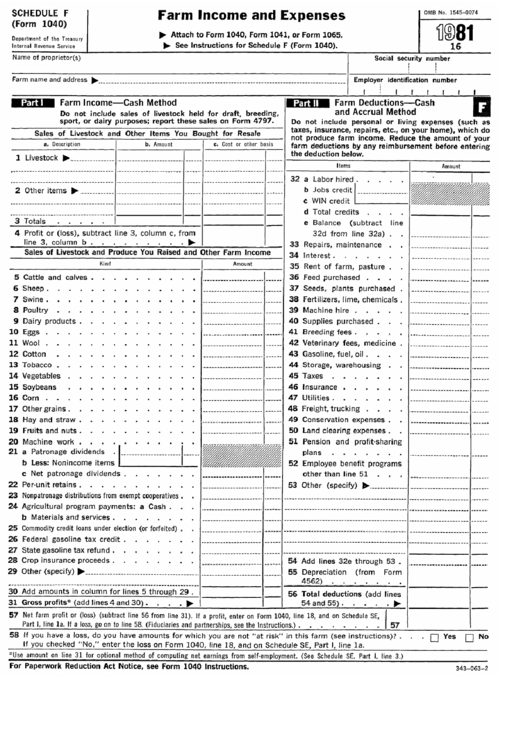

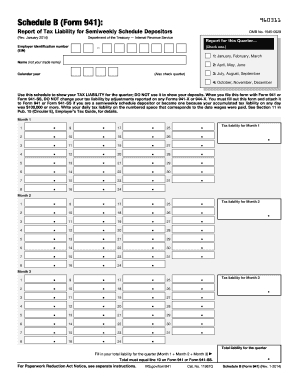

September 15, 2021: Deadline for third-quarter estimated tax payments for the 2021 tax year. June 15, 2021: Deadline for second-quarter estimated tax payments for the 2021 tax year. April 15, 2021: Deadline for filing business returns for sole proprietorships and single-member LLCs also the deadline for first-quarter estimated tax payments for the 2021 tax year. March 31, 2021: Deadline for businesses to electronically file Form 1099 and Form 1096. March 15, 2021: Deadline for filing business return Forms 1120, 1120-A, and 1120-S for partnerships, multiple LLCs, and S Corporations. March 31, 2021: Deadline for electronically filing Form 1097, Form 1098, Form 1099, Form 3921, Form 3922, and Form W-2G. March 1, 2021: Deadline for businesses to mail Form 1099 and Form 1096. Febru: Deadline for paper-filing Form 1099-MISC documents that don’t have claimed amounts in Box 7. 1, 2021: Deadline for employers to mail out W-2 Forms to their employees also the deadline for businesses to provide Form 1099 to contractors January 31, 2021: Deadline for submitting wage statements and forms for independent contractors. Janu: Deadline to pay the fourth-quarter estimated tax payment for tax year 2020. Here are the can’t-miss-it 2021 tax dates that every small business taxpayer should know: It’s not just your mom’s birthday you need to circle on the calendar anymore small businesses owners have many dates to remember. Small business tax forms | Form 940 | Form 941/Schedule B | Form 1099 | Form W-2 | Form W-4 | Form 1040/Schedule C | Form 1065 | Form 1120 | Schedule SE | Form 8829 | Form SS-4 | Small business tax terms to get familiar with | Important tax dates for your calendar We recommend reading through the entire article, but you can also follow these links to skip to the sections that are most relevant to you. In this article we’ll translate even the most convoluted government tax talk into digestible information that will keep your business running smoothly all year long. We created a streamlined guide to the 30 most important small business tax forms, terms, and dates you need to know to file accurately and efficiently. We’re here to help you ease into the 2020 tax season. On top of that, you must comply with strict, federally mandated deadlines to avoid late penalties.

With dozens of numbered forms, complex accounting software, and confusing terminology, familiarizing yourself with the process can be overwhelming.

If you’re a small business owner, filing business taxes can be intimidating. Tax season comes around every year and, despite its inevitability, handling it all remains a challenge.

0 kommentar(er)

0 kommentar(er)